The linking of 12 digit aadhaar number to the employee provident fund bears a good number of advantages. This is going to help every employee who is intended to draw out money from their EPF Account. The provident fund is a perfect scheme which is a plan generated for the employees and the employer jointly contributes towards the fund and that will be received by the employee with interest after retirement.

The EPF is represented through the UAN number or is called the universal account number to which aadhar needs to be linked for generating PF now. Today it have been considered mandatory to link aadhaar number with the universal account number as being established by the employees provident fund organization. The following can be done both online as well as offline with the UAN number to link the EPF account.

Steps to link aadhaar to EPF account

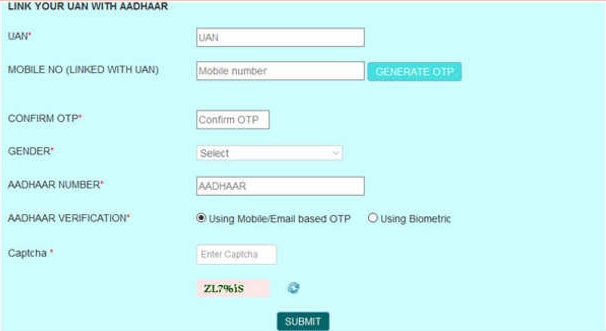

Today the EPFO is providing the online process to link the aadhaar with the PF through their web pages. Here come the steps.

- One needs to visit unifiedportal.epfindia.gov.in which is the PF webpage.

- Next select the “UAN Member e-sewa” link under the “for employees” tab.

- Create your pass word and login id with the UAN and directly login to the source page.

- Move to the “manage” tab and then you can select the “KYC” option.

- This will further direct the users to the page where you will find the tabs to upload the number of documents which needs to link with the EPF account.

- Next select the tab that states “aadhaar”.

- Further you can fill your name and aadhaar card number correctly and save it to move to the next.

- Just post this and then your aadhaar number will be verified by the UIDAI’s database.

- Once the process approves your KYC documents by the employer and the UIDAI, the EPF account will easily get linked to the aadhaar card.

- You can next check out the status and that will further get verified which will be written next to the card number.

Linking offline

For offline linking, you must be present physically at any of the EPFO’s branches or at common service centers. Next submit the application with self attested photocopies of the aadhaar card, PAN and UAN which can be preceded with post verification the aadhaar card will be linked to the EPF account. Then the user is going to receive a notification on the registered mobile number for the same.

Benefits

- The EPF account when linked with aadhaar is going to reduce the chances of errors with EPF and UAN.

- Prevents any kind of misuse in the form of a duplicate account and the employee can hold a single EPF or an UAN account linked to the aadhaar card.

- After the linkage the card holder can easily withdraw money without the permission of employer.

- This makes convenience to verify the details if you are linking your aadhaar card with the EPF accounts. The reason is the biometrics and demographic information.

This process is generated by the government of India for helping every citizen have a safe and secured life even after retirement.

Leave a Reply